May 2025

If you’re setting up a Dutch Holding BV in the Netherlands, one of the smartest moves you can make is to use a Dutch holding structure. This structure isn’t just for large corporations — it’s a valuable tool for startups, SMEs, and entrepreneurs who want to save taxes, protect assets, and plan for long-term success.

Drawing on Daniel’s extensive experience with holding structures at major trust companies, this guide explains how the Dutch Holding BV works, why it matters, and how to set it up.

What is a Dutch Holding BV?

A Dutch Holding BV is a private limited liability company (Besloten Vennootschap) that holds assets such as shares, intellectual property, or real estate. Unlike an operating BV, it doesn’t carry out commercial transactions — its role is purely to hold and manage assets.

Most entrepreneurs use a holding structure where the holding BV owns the shares of one or more operating BVs, creating flexibility and protection.

Why set up a holding structure?

Here’s why entrepreneurs choose this setup:

1. Asset Protection

By placing valuable assets in the holding BV, you shield them from risks in the operating company, such as bankruptcy or lawsuits.

2. Tax Benefits

Thanks to the participation exemption (deelnemingsvrijstelling), a holding company that owns at least 5% of an operating BV pays no tax on dividends or capital gains. Without this, individuals would face around 26.9% tax (2025 rate) on these proceeds.

3. Corporate Tax Optimization

Each BV pays 19% corporate tax on the first €200,000 of profits. With a holding + operating setup, you can allocate profits smartly and stay within the lower bracket.

4. Exit and Succession Flexibility

Selling an operating BV within a holding structure lets you reinvest profits tax-free, provide loans, or plan distributions on your own terms.

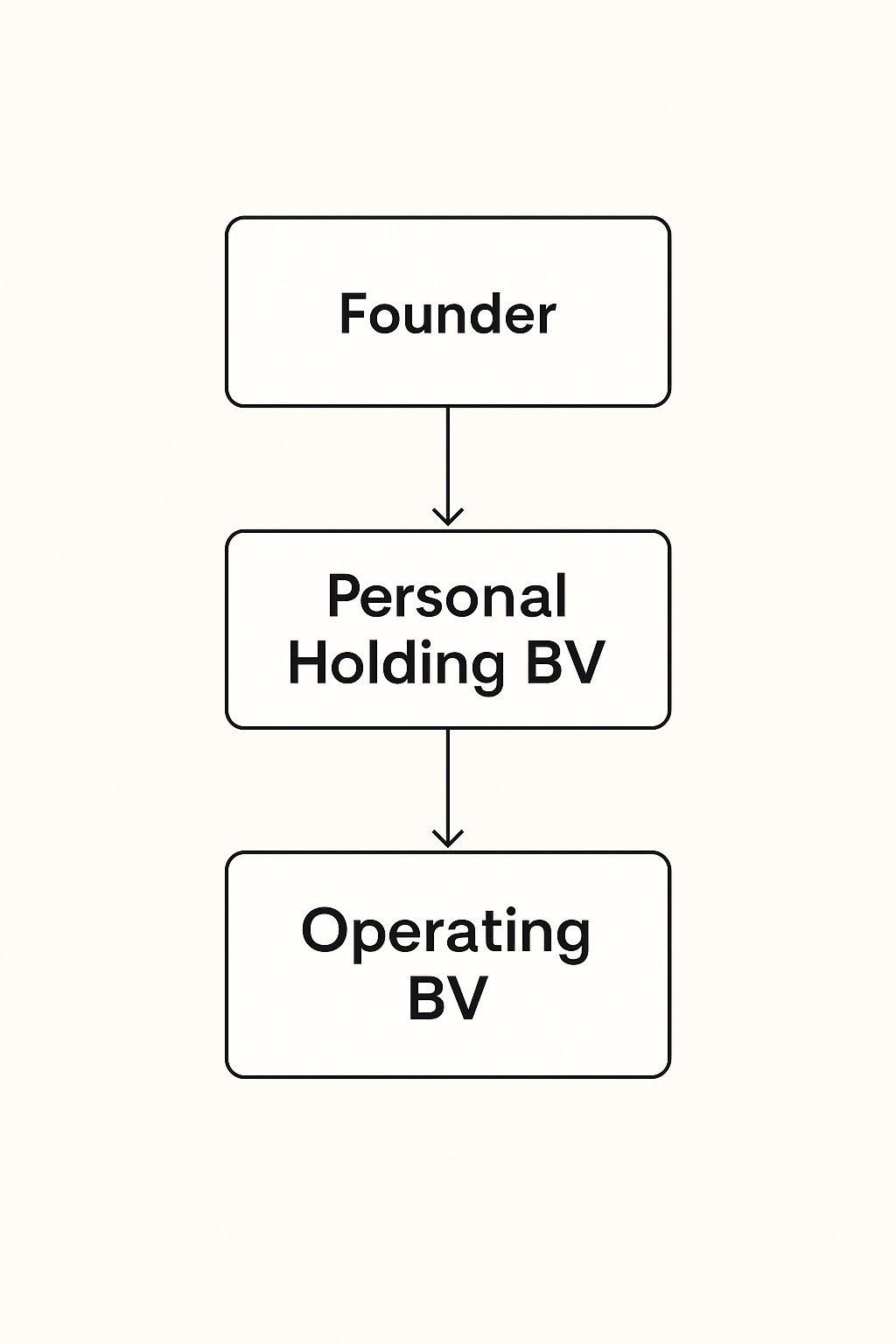

Typical Dutch holding structure

Here’s what a standard setup looks like:

For two founders, each sets up a personal holding BV, and these holding companies own the operating BV together.

Key setup points

- Directorship: Founders usually direct their own holding companies.

- Management contracts: Holding BVs can sign contracts with the operating company to receive management fees.

- Minimum salary rule: The Dutch “gebruikelijk loon” applies to director-shareholders.

When to set it up

Recommended if you:

- Plan to scale or bring in investors.

- Want to protect personal assets.

- Expect to sell the business.

- Intend to reinvest profits efficiently.

Not needed if you:

- Are a solo freelancer or contractor without significant risk.

Tip: Setting up a holding structure at the start avoids complex restructuring later.

Common mistakes to avoid when setting up a Dutch Holding BV

While a Dutch Holding BV offers many benefits, entrepreneurs often overlook important details:

- Waiting too long to set it up: Many founders start with just an operating BV and only think about adding a holding later. However, restructuring later involves notarial deeds, share transfers, and sometimes tax consequences. It’s usually cheaper and simpler to set up the right structure from the beginning.

- Ignoring director’s liability: Even if you appoint your personal holding BV as director of the operating BV, you remain personally liable as the director of the holding company. Setting up a holding BV does not shield you from legal responsibility.

- Forgetting the minimum salary rules: As the director of your holding BV, you must comply with the “gebruikelijk loon” or customary salary rules, even if you take income through management fees.

By addressing these points early, you can ensure your Dutch Holding BV structure is both compliant and effective.

How to set up a Dutch holding company

To set up this structure, you need:

- Articles of association via a notary.

- Registration at the Dutch Chamber of Commerce (KvK).

- A Dutch bank account.

- Share capital (usually €1).

- Tax registration (passive holding BVs typically don’t need a VAT number).

Expert insights from Daniel

With years of experience advising on holding structures at major trust companies, Daniel has helped countless entrepreneurs design tax-efficient, flexible setups. Whether you’re launching a startup or running an established business, he can help you navigate the process.

Want to learn more? Check out our company formation services or our CFO advisory services.

Conclusion

A Dutch Holding BV is an excellent tool for tax efficiency, asset protection, and business flexibility. Setting it up early can save you time and money.

Ready to get started? Contact Daniel today for personalized advice.